Good day, fellow distinguisher of kW vs kWh ⚡🔋

The confusion kept on coming this week, with question marks around maintenance of the Alternative Fuels Data Center and chargers to be removed from government property because the future of transportation is, apparently, “not mission-critical”.

Roll up your sleeves for an extended tussle to keep EV adoption and charging infrastructure on track. For now, once more unto the breach with our latest EVI digest… ⤵️

California Steps Up State-Level Charging Program

News - CALeVIP announced the Fast Charge California Project (FCCP), which will launch this summer and provide $55M for public DC charging expansion across the state.

Numbers - Incentives can fund 100% of total project costs, capped at $100,000 per port for 275kW+ ports, or $55,000 for 150kW ports. This would fund up to 20 ports per site.

FCCP Details - California EV Infrastructure Project

Nuance - Projects must meet Tier 1 “EV Ready” requirements, which essentially means utility service designs prepared and permitting processes complete. The program specifically targets rapid deployment, unlike the elongated planning associated with California’s NEVI buildout.

Next Up - Additional details will be announced before summer, when the window for FCCP applications opens on 8th July at 9AM (Pacific). Interested parties can sign up for updates here and read the FCCP Implementation Manual.

Charging Vendor Spotlight: Red-E Charge

News - Red-E Charge is based out of Detroit, MI, and recently passed the significant century milestone with 100+ fast charging locations operational.

Numbers - 102 stations that include some level of DC fast charging with 360 ports, 78% (280) of which are DCFC ranging from 50kW to 350kW. The network covers 23 states.

Red-E fast charging station using AUTEL hardware (Credit: Red-E Charge)

Nuance - The company has expanded from an initial buildout in its home state of Michigan to cover almost every region of the United States, to varying degrees. The Northeast and Southeast represent strong markets for Red-E, which is deploying hardware for both DC and destination charging. Dealerships, municipalities, and retail centers have been the basis for much of Red-E’s growth to date.

Next Up - On the funding side, Red-E has been in the middle tier of applicants for NEVI, with awards in eight states so far. How much that program contributes to its expansion will depend on decisions by state DOTs and courts in the months ahead, but wider progress in key EV markets suggests a strong future for the network.

AC/DC: EV Passport + CBRE Partner for 3.6K L2 Chargers

News: Property giant CBRE will work with Santa Monica-based EVPassport to deploy AC charging at multifamily and hospitality sector locations.

Numbers: 3,600 L2 chargers to be deployed across 600 sites in the United States. 54% of CBRE’s 2024 occupier research respondents indicated that a lack of EV charging would impact their decision-making around property selection.

Destination chargers at a hospitality property in Rhode Island

Nuance: Potential tenants increasingly view AC charging as an essential amenity, rather than the interesting side benefit it has been in the past. 41% of those surveyed by CBRE in 2024 said that they would either walk away from a property or seek discounts on pricing if EV charging was not included on-site.

Next Up: This partnership adds to a 2024 collaboration with EV+ that plans 10,000+ charging spaces at CBRE locations including hotels, healthcare facilities, and residential complexes, over the next five years. Multiple vendors are required to deliver at the speed and scale requested by customers, according to CBRE’s EV Solutions lead, Jim Hurless: “We have such a large demand for charging infrastructure across the U.S., we need to have many other providers to meet it.”

On the Road: This Week in DCFC

News - As tNAC highlighted this week, AFDC additions are dropping despite the fact that new stations are coming online. This could be a temporary blip, but it could also be a leading indicator of the resource being abandoned as cuts take hold. For now, we’ll still report its numbers, but know that much more is likely happening beyond AFDC records.

Numbers - 38 new fast charging stations across the United States and Canada were added to AFDC listings this week. The North American station count hit 14,459 at the end of the week, with DCFC making up 17% of total AFDC listings.

Notable Locations Added to AFDC:

⚡ Francis Energy added another NEVI-funded station in Carlisle, PA, the network’s second in the state and sixth NEVI activation overall, after four in Ohio last year.

🟦 FLO continued the network’s growth with Alabama, adding a third location in Headland, AL. The station has 2 × 125kW stalls with Alabama Power, at $0.42/kWh.

📍 Four new ChargePoint stalls at IGA Trois-Pistoles add to the scarce charging options in this Quebec town on the banks of the St. Lawrence River. Other than this station, only a solo 50kW dispenser from Electric Circuit is available for EV drivers passing Trois-Pistoles.

🔵 Eight new 350kW stalls add to EVgo’s network at the Gateway Plaza retail center in Fremont, CA, where an older 50kW station on the network has been showing its age and limitations. An existing 250kW Tesla Supercharger is also present at the center.

🟢 Electrify America opened a new six-stall location in Fairview Heights, IL. The location sits near the state border with Missouri, which has plenty of DCFC options but will be a convenient stop within a half mile of the I-64 exit at the St. Clair Sq. retail center.

⚫ Blink Charging added two new stations in Wisconsin, both at dealerships, serving Arcadia and La Crosse, WI, respectively.

Unfortunately, with AFDC updates in question, the weekly video digests of new fast-charging locations from The Network Architect Channel on YouTube are now paused. Hopefully, earlier DCFC updates like this one can return if alternative arrangements are made to keep track of new stations.

Pricing

The small number of stations posting DCFC rate changes continues to shift our pricing index of 300+ representative sites. Last week, it was iONNA and ROVE Charging price cuts dragging the average price down one cent to $0.52 per kWh.

However, this week it’s back in the opposite direction, with price hikes across the Rivian Adventure Network pushing the index average back up to $0.53 per kWh.

Nowhere is the pricing increase more apparent than Rivian’s compelling new Charging Outpost in Joshua Tree, CA, where the rate for non-Rivian EVs rose to an offputting $0.74 per kWh. Rivians pay a slightly lower fee at $0.63 per kWh, but the pricing strategy sits in stark contrast to the much larger Tesla Supercharger network, which has been openly putting downward pressure on DCFC fees.

Last week in California, charging hub newcomer ROVE dropped its prices by a full 10 cents, to $0.48 per kWh. That makes it disappointing to see Rivian heading in the opposite direction, though more remote sites can carry high operating costs.

The prices of NEVI sites continue that upward trend, with the average across 59 federally funded sites also rising by one cent to $0.51 per kWh.

In addition to the RAN price increase pushing up the fee at Rivian’s sole NEVI site in East Lansing, MI, new sites have also been added with prices at the expensive end of the spectrum.

Both new Francis Energy sites in Pennsylvania set new highs for the network in the Midwest, at $0.62 per kWh each, while prices at Francis’ Ohio sites also went up by five cents at each a week earlier.

One exception to higher NEVI site pricing comes from the new Pilot site in Skippers, VA, where the $0.52 per kWh fee isn’t exactly low, but does slide in at five cents lower than the Pilot-Flying J average of $0.57 per kWh. P-FJ certainly runs the gamut of pricing, with its lowest cost sites a fairly reasonable $0.45/kWh, but the highest hitting $0.69/kWh.

*Note: An index for Canadian stations is nearing completion and expansion of the U.S. pricing index is underway. Look for those to debut in a digest soon.

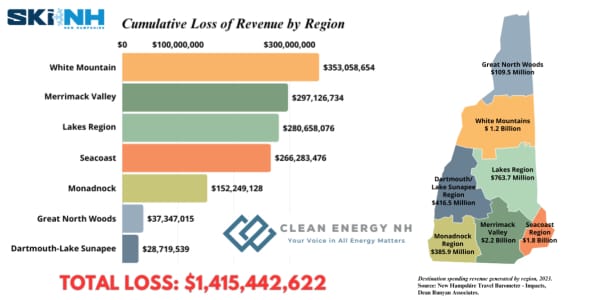

News - A study by Clean Energy NH and Ski New Hampshire estimates that failure to build sufficient EV infrastructure stands to lose the state billions of dollars in revenue from lost tourism by 2031.

Numbers - Of that $1.4 billion figure, the White Mountains tops the list of potential revenue lost, with more than $350 million hemorrhaged to other states and abandoned trips.

Nuance - New Hampshire’s charging infrastructure has lagged neighbors like Maine and Vermont, both of which have state-level EVI programs dating back to VW Dieselgate settlement funds. NH has 145 fewer public charging stations than similarly sized Vermont, for example, with coverage also much less evenly spread than its neighbor. Most of the fast charging stations serve the south of the state, while tourist destinations to the north are limited to Tesla Superchargers, which make up one-third of New Hampshire’s DCFC.

Next Up - New Hampshire is one of several states to pause its NEVI program activity, pending further guidance from the FHWA. Although the four stations announced in the state’s first round of awards would help open up regions like the White Mountains to EV drivers, that number will need to be accelerated at least tenfold to fill glaring gaps in the state’s charging infrastructure and win back business from New England EV drivers.

Fleet Focus:

News - In a Q&A with AMZL Energy’s Patrick Leonetti, the PNW-based Project Manager shared highlights of his work electrifying Amazon’s delivery fleet. Joining as one of the team’s earliest hires in 2021, Leonetti’s personal and professional insights into deploying fleet charging infrastructure at scale are illuminating.

Numbers - As of late 2024, Amazon had reached 20,000 electric delivery vans (EDVs) for last-mile delivery across the United States. More than 24,000 chargers at 150 delivery stations support this all-electric fleet. This puts the company on a clear trajectory to reach between one-quarter to one-third of its 2030 target this year.

Patrick Leonetti, Manager Program Management AMZL Energy (Credit: Amazon)

Nuance - Leonetti shares that after several years deploying in US cities, the AMZL Energy team recently turned its attention to Canada. “We launched our first site in Vancouver, BC in November,” he says, of the team’s 2024 expansion, adding that a “second site will launch in Halifax, NS” by the end of this month.

Next Up - The AMZL Energy team's mission is to develop/deploy the infrastructure required to charge 100,000 electric delivery vehicles across the Amazon delivery network in North America. This is in support of the Amazon Climate Pledge, which sets goals for 2030 and an overall objective of Net Zero operations by 2040.

For Your Listening Pleasure

Every edition, we recommend one of the best listens on electrification, energy, or something similarly EV-related. This week we have the Directly Current podcast, which falls under the umbrella of Mike Murphy’s EV Politics USA organization.

Tom has covering the North American EV space for more than a decade and there are few people who know more about charging. Hear him unpack the latest developments in DC fast charger hardware and what makes a good home charging setup in this episode.

That’s your EVI update for another week. It can’t always be packed with positive news, of course, but the broader trajectory of the sector and sales of electric vehicles continue upward.

So, if you found this digest valuable, pass on the positivity by sharing it with a friend or colleague.

And remember, it’s not range anxiety if your average efficiency is trending upwards 📈🛣️

Cheers,

Steve

Essential EV Follow - Steve Taylor

At this point, Steve Taylor needs no intro to Linkedin users. His weekly news and employment summaries are renowned across the platform!

However, for those not active on Linkedin, it’s well worth reviewing his output, especially if you want to work in the sector. The weekly EVPowerPulse newsletter is also a valuable resource that EV enthusiasts will enjoy.