Good day, fellow gas passer ⛽👋🏻

Policy concerns continue to offset positive EV infrastructure news this week, as the US House proposes a distinctly anti-EV budget and Uber’s electrification targets are called into question, despite positive electric ride reports from drivers and customers.

At the same time, EV registrations in March rose 20%, outpacing the wider US auto market increase of 14%, while potential North American charging giants iONNA and Walmart Energy continue to develop expansion plans across the United States.

Whether you’re feeling the electrification glass is half empty or half full, there’s plenty to sip on in our weekly pour of EVI developments ⤵️

📢 Uber Will Electrify, But Target Dates in Jeopardy

News - Uber’s Head of Electrification, Rebecca Tinucci, confirmed that the rideshare giant has made significant progress in developing a fleet of zero-emission vehicles (ZEVs) for drivers. However, Uber will likely fall short of 2025 milestones, based on its Q125 trajectory, and 100% electric rides by 2030 will be out of reach without assistance.

Numbers - In the U.S. and Canada, 9.1% of ride-hailing miles are now completed in electric vehicles, up from 8.2% in the first three months of 2024. Globally, more than 105 million ZEV trips were logged in the first quarter of 2025.

Nuance - Despite near- to medium-term targets seemingly slipping out of reach, Tinucci remained upbeat about the overall path of Uber’s electrification project, both in terms of customer experience and driver satisfaction. “More customers want to ride in EVs,” she confirmed in the same update, adding that “EVs have lower operating costs than gas-powered cars, meaning that drivers see higher net pay.”

Next Up - Stronger, aligned action from public and private entities is what Tinucci and Uber say is required for sufficient infrastructure and cost reductions to be achieved, if 100% rideshare electrification is to become a reality. Given the current political climate and the policy positions on display elsewhere in this edition, it seems unlikely that the public side of the equation will contribute. In fact, it could be a drag factor on progress.

🔍 Charging Vendor Spotlight: 7Charge

News - 7Charge is the EV charging brand of renowned convenience retailer 7-Eleven, which has almost 10,000 stores in North America but remains a minor player in EV charging.

Numbers - 153 fast charging ports at 44 stations, spread across eight states in the USA (primarily Florida and California) and two provinces in Canada (Alberta and BC).

7Charge station, Kamloops, British Columbia | Credit: PlugShare

Nuance - What started as potentially a nationwide DCFC rollout in 2022/23 has petered out to just a handful of station openings over the past six months. 7-Eleven’s proposed merger with the parent company of Circle K, Alimentation Couche-Tard, has perhaps complicated matters. Despite early progress and positive reception for Circle K stations, the latter has also slowed its EV charging program. One area of alignment lies in the hardware, as both 7Charge and Circle K Charge stations use ABB chargers.

Next Up - Watch those merger talks. The combined convenience retail and fueling footprint of Circle K and 7-Eleven in the US and Canada holds great potential, but charging stations aren’t typically built overnight and the North American charging landscape will look very different by the time any new organization emerges.

🔌 AC/DC: Madison Elevates Its L2 Charging Options

News: The City of Madison unveiled new level 2 destination chargers in partnership with MG&E. The chargers are mounted on utility poles around 10 feet off the ground.

Numbers: Five new pole-mounted AC chargers, bringing the city’s total to 57 chargers, most of which are level 2 destination charging stations.

A version of the pole-mounted chargers used by MG&E, deployed here in Massachusetts

Nuance: We’ve seen this subtle destination charging solution before, not far from us on the streets and poles of Melrose, MA. A pilot by National Grid in 2022 was expanded but has seen limited uptake in other parts of the country. Although savings of up to 70% on the cost of installation are undeniably attractive, competing service use from communications companies and the fact that not all utility poles can support the charging hardware make deployment more complex than it might initially appear.

Next Up: Only a handful of cities have replicated the model laid out by Melrose (and Los Angeles before it), including Seattle, WA, and Madison, WI. The new additions following the city’s first installations in late 2023 show that communities offering this solution tend to appreciate the option, which we expect to see in more densely populated areas as EV adoption increases.

🛣️ On the Road: This Week in DCFC

News - Only a steady week of activations and additions to the Alternative Fuels Data Center (AFDC), but many of the big players were in action. Chief amongst them, Walmart is flexing its muscles in DFW and, further up the planning pipeline, we see the company applying for permits in Arizona, Florida, and Washington.

Numbers - 162 fast charging ports at 50 charging station locations added to AFDC listings this week.

Notable Stations + Additions to AFDC

⚡ Walmart Energy opened its fifth own-brand fast charging station, and the fourth in the Dallas-Fort Worth metro area. Store 1778 in Bedford, TX is the latest activation (and largest yet, with six dispensers/12 stalls), nestled neatly between the two cities and adding to those north of Dallas that were opened over the past six weeks. Construction is underway across at least 10 more store locations in the DFW area, so expect momentum to build as we head into the summer months.

🗽Another NEVI site on the map courtesy of the Electrify America/EVolve New York partnership, with Angelica, NY open. This bridges the stretch of I-86 along upstate NY’s Southern Tier, which now has seven EVolve NY locations, four of which were assisted by funding from the embattled federal charging program. The NEVI map continues to grow.

🍁 Making out way up to Manitoba, Winnipeg Gas Bar might not be the first brand name you’d head to for EV charging. However, three 100 kW station additions from FLO this week could make the chain a more frequent consideration for the hearts and wallets of electric vehicle owners in the city.

A new Rechargery for Valdosta, GA | Credit: iONNA

🟠 Every new iONNA station is exciting, not least for the consistent canopies and stall count, but this week’s new pin is made special by adding another state to the map. Georgia builds on the network’s presence in the southeastern US with its first Rechargery Relay in Valdosta, GA. This exit of I-75 now has four nationwide charging providers within half a mile of each other, emphasizing the increasing competition in US DC charging.

🔴 Tesla confirmed new Supercharger locations in Florida, California, Mississippi, Nevada, Virginia, and Washington state. Of particular note this week is a new 24-stall site in North Las Vegas, NV, which is much-needed in a city notorious for its wait times at peak charging periods, and a mammoth 68-stall site in Montebello, CA.

New EA station in Arlington, TX | Credit: Electrify America on Twitter/X

🟢 In addition to its work with New York state, Electrify America also energized a new six-stall spot in Arlington, TX. This location sits immediately off of I-30, in the heart of an entertainment district with ample dining options and the adjacent Aloft hotel, for anyone who needs to sleep off a little too much food or fun.

⭕ Special mention to a neat addition from Red-E Charging, which doesn’t break barriers in terms of power (160 kW) or stall count (four), but does catch the eye with a full canopy, pull-through stalls and, most impressively, a $/kWh pricing sign that we’d love to see at many more charging locations across North America.

Steamer’s Stop Red-E Charging Station | Credit: Megha Lakhchaura/LinkedIn

⚡ Pilot-Flying J adds another pin on its path to 200 stations, with a new four-stall spot energized in Marshall, IL. Pricing is on the higher end of P-FJ’s spectrum, at $0.63/kWh.

✅ Francis Energy powered up its second NEVI station in the state of New Mexico, with an activation in the far north of the state. Raton, NM add two dispensers and four new stalls. At $0.66 per kWh, pricing isn’t as egregiously high as some other Francis sites but comes in more than 20 cents higher than Tesla’s NEVI site in Lordsburg, NM.

To see how and where the leading charging vendors are expanding, check out The Network Architect Channel on YouTube for DCFC updates like this one.

💲DCFC Pricing: Newcomer Intro Pricing Offsets Rate Creep Among Incumbents

News: Introductory/welcome rates at rising charging vendors like iONNA, Mercedes-Benz, and bp pulse are set below current market rates, while established providers like Francis Energy and EVgo are seeing pricing tick up at a handful of existing locations.

Numbers: A high of $0.83 per kWh in Matfield, KS represents the peak of Francis Energy pricing upticks over the past month, while intro rates set between $0.34-$0.40 per kWh by newcomers offer alternatives, however temporary, for EV drivers in competitive markets.

Nuance: Charging vendors with pricing on the high side of the market average, such as Pilot-Flying J, can still be influenced by competitors entering their territory, it seems. Take London, OH, home of the very first NEVI site, where P-FJ set pricing at $0.65 to $0.70 per kWh for the past year. Enter a new bp pulse location last month — right across the road, with pricing set at the network standard $0.48 per kWh — and Pilot’s site drops to $0.58 per kWh within a few weeks.

Next Up: Price competition is still in its very early stages when it comes to DC fast charging in North America. Expect to see much more dynamism in rate setting and new pricing mechanisms experimented with throughout the summer, as competition for EV driver dollars by iONNA, MB-HPC, Walmart Energy, and others ramps up.

✒️ Policy: Proposed US Budget Takes Aim at Clean Energy & Transportation

News - A budget bill proposed in the US House this week slashes at initiatives moving the country towards cleaner transportation and improved health outcomes, with EV incentives and emissions standards on the chopping block.

Numbers - The old 200,000 EV sales cap could be back, with the $7,500 Clean Vehicle Credit curiously extended to the end of 2026 for automakers who have sold fewer than 200K electric vehicles in the US between 2010 and 2025. That same cap was a feature of Obama-era ZEV incentives that were eventually updated by the Biden administration, albeit at a time when very few electric vehicles had been sold.

Nuance - House Republicans in districts that benefit from low-carbon energy project investment have advocated for some initiatives to remain in place, while harder line caucus members demand deeper cuts. The long-anticipated loss of the federal EV tax credit could set up a banner year for EV sales in 2025, as consumers are given the remainder of the year to squeeze in their purchase of most models at a $7,500 discount.

Next Up - If passed as proposed, clean transportation progress in the US will revert even further to the state-level than it already has, following a whirlwind of executive orders targeting EV infrastructure and clean energy earlier this year. With progress potentially stalled in certain parts of the country, watch for investment to shift to states that step in to fill the holes left by regressive federal policies.

🚛 🚍 Fleet Focus: 2/3 of Parents Cite Benefits of Electric School Buses

News - A survey from Highland finds a correlation between electrifying vehicles in educational fleets and improved health outcomes at school.

Numbers - 67% of parents surveyed linked positive outcomes around their child's emotional and academic success, in part, to the reduction in noise and emissions that electric school buses deliver. Similarly, 71% of mothers cited concerns about exposure to emissions as a reason to choose electric over diesel transportation to and from school.

Nuance - Naturally, a survey conducted and shared by an electric vehicle provider will emphasize the benefits of their chosen technology. However, any parent who has picked up their child while an aging diesel school bus idles next to the entrance can attest to the noise and diminished air quality associated with such vehicles. It stands to reason that parents are in favor of removing those pollutants from the daily lives of their children.

Next Up - As with many electrification efforts, adding EVs to school fleets is now heavily dependent on how their state views the move to electric vehicles. For those progressing the transition to cleaner transportation, a majority of parents are likely to join them on the journey.

🎧 For Your Listening Pleasure

In every edition, we recommend one of the best listens on electrification, energy, or something similarly EV-related.

Back to Coast-to-Coast EVs this week, as Smappee’s David Streitfeld helps us unpack the potential of smarter AC charging for electric vehicles:

The conversation moves beyond EVs to the nuances of energy management and how intelligent charging products can orchestrate the many aspects of generation, storage, and delivery.

🧮 Data Dive - Electrify America 2024 Report

After unpacking EVgo’s first quarter in edition 18, this week’s dive comes from Electrify America’s reports on 2024 activity.

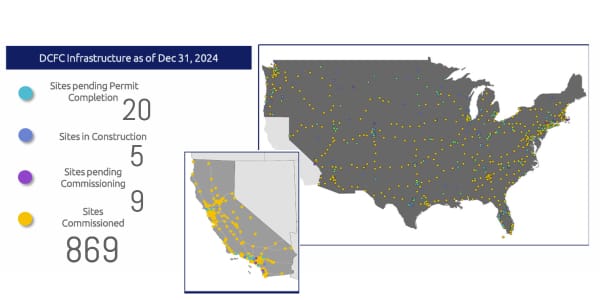

EA network status at 12/31/24 (Note: does not include Electrify Commercial locations)

It’s worth noting that EA prepares separate reports for the California Air Resources Board (CARB), so “national” refers to activity in all states except California. The figures below are combined from the two reports to give a truly national reflection of the network in 2024.

⚡55 new stations with 258 fast charging ports energized in 2024. Entering 2025, 33 additional locations are in the design/permitting/construction phase.

⚡191 locations upgraded to latest generation of hardware from BTC Power and SK Signet. This represents around 18% of the nationwide network at the end of 2024.

⚡Average permitting time in California is 121 business days, 15% longer than the 104 business days average in all other states

⚡Utility rate reforms, especially around demand charges, reduced Electrify America’s utility bills by $5.3 million in 2024. More than one-third of the savings were in California.

⚡$75 million has been allocated for network-wide reliability upgrades for the 18-month period from July 2024 to December 2026, when Electrify America’s fourth and final planned cycle of mandated investment comes to an end.

What data from the report jumps out at you?

Hit reply to share your thoughts or to recommend a data dive item for future editions.

🔋💯Topping Off…

Here are a few additional items we couldn’t squeeze into other sections or have covered to some degree in earlier editions:

If you found this edition useful, consider forwarding it to a friend, colleague, or family member to share our efforts.

See you next week and remember, every modern EV owner has at least two days’ worth of home electricity use sitting outside 🔋🏠🔌

Cheers,

🔔 Essential EV Follow - Rebecca Tinucci

As Head of Electrification and Sustainability at Uber, Tinucci leads one of the key clean fleet efforts in North America. Her previous role heading up Tesla Charging gives her unparalleled experience/achievements in the space.

She frequently speaks at leading sustainability events, sharing high-level insights on electrification and clean transportation.