Good day, fellow all-electric record applauder 🔋🛣️✅

The ups and downs of the industry were on display this week, with one end of the charging sector in damage limitation mode, just as another confirmed how well its long-term plans are shaping up.

There’s little doubt that electric vehicles have a bright future, but who will still be there to serve them in 2030 and beyond remains an open question.

With that glass half full scene setting, here’s a rundown of this week’s developments in EVI across North America ⤵️

📢 FLO Charging Facility Closure Points to Economic Uncertainty + US Trade Policy

News - Canadian charging vendor FLO announced it will shutter a manufacturing facility in its home country, with a wider restructuring also impacting its US facility in Michigan.

Numbers - 30 workers will lose their jobs at the Shawinigan facility in Quebec, with a total of 80 employees impacted by broader company layoffs.

FLO station at a Metro grocery store in Canada | Credit: FLO

Nuance - Although this isn’t a fatal blow for FLO, it emphasizes the current climate for many businesses, especially those in the EV, clean energy, and charging spaces. As trade battles unfold, federal support for EVs in the US turns to antipathy, and OEMs embrace their fallback plan of more hybrid vehicles, companies that are fully invested in the BEV sector face a stern test, to tighten up operations and ride out the storm.

Next Up - In the near term, focusing on core operations and profitability is the order of the day. Longer-term strategic moves, such as running multiple manufacturing facilities to serve diverse markets, must take a back seat until the more chaotic aspects of US trade policy settle down and the landscape of industry incentives becomes clearer.

🔍 Charging Vendor Spotlight: iONNA

News - Rising network iONNA, backed by eight global automakers, has announced its first locations in collaboration with C-store chain Wawa. iONNA also confirmed that 10% of its sites targeted for 2030 are now identified and under contract.

Numbers - 3,064 charging bays are now contracted, which represents more than 10% of the company’s 30,000 bay target by the end of 2030. In terms of active stations, iONNA is at 202 DC fast charging stalls (“bays”) at 21 locations (“Rechargeries”) in 10 states (“no special iONNA terminology for states… yet”).

iONNA’s Scranton Rechargery

Nuance - For all of iONNA’s early progress, there are still skeptics within the EV space who doubt the network’s ability to reach its lofty goals. One rather harsh commenter on a recent tNAC network update called the progress to date “crawling speed”. The reality, as this week’s announcement emphasizes, is quite different. While visible construction is more exciting for EV drivers, the contracting and permitting stages lay the foundations for any new network. With 10% of their original target already in place before the team really hits its stride, and more than five years until their own deadline (end of 2030), we’re seeing the kind of regional partnerships and multi-pronged expansion strategy that could make iONNA North America’s second-largest charging network before the decade is out.

Next Up - In the near-term, iONNA’s release confirmed 400 new bays/stalls under construction, which equates to around 40 locations. The first Rechargery @ Wawa will open this week at W. International Speedway in Daytona Beach, FL, with another three Florida Wawas also under construction and likely to see a late summer opening.

🔌 AC/DC: First Wave of L2 Chargers in San Diego Upgraded, With New Stations Ahead

News: Virginia-based charging vendor EVerged has completed the first phase of a larger contract with the City of San Diego, which will deliver thousands of new L2 charging destinations across the city by 2030.

Numbers: Chargers will be installed at approximately 400 city parking lots. The first round of activations encompasses 12 upgraded locations at valuable community destinations, including libraries, museums, and the nationally renowned San Diego Zoo.

Nuance: Charging provider EVerged, using software from its partner AMPECO, will supply and maintain the new chargers at no cost to the City of San Diego. The 10-year contract comes with reliability requirements, while the City provides the property for the chargers and collects a portion of the revenue, along with the charging provider.

Next Up: With the existing charging locations upgraded, EVerged will now work with the city to deploy around 2,500 chargers for public use and another 1,500 at municipal locations. The deployment will occur gradually over the next five years.

🛣️ On the Road: This Week in DCFC

News - A quieter week for additions to the Alternative Fuels Data Center, although new station openings from Red-E, Rivian, and Electrify America, point to existing charging vendors strengthening their networks as new players like iONNA make encouraging progress on their expansion across the US.

Numbers - 197 DC charging ports at 47 charging locations added to AFDC this week.

Notable New Stations + AFDC Additions:

🟢 Electrify America made some strong statements this week, including a commitment to 10 stalls (minimum) at all charging sites currently in planning and moving forwards. On the ground, four station activations represent the spectrum of past to present, with four stalls at a Sheetz in York, PA, encapsulating the early days of EA installs. At the other end, 10 stalls at a Costco in Highland, CA, looks like the kind of site EA’s Rachel Moses promised in her Reddit AMA earlier this month.

🛒 Walmart Energy is close to opening in another state, with a “ready-to-energize” location uncovered by Landon at The Arkansas eTraveler and his enthusiastic community of site spotters. The first expected site in Oklahoma can be found in Checotah, with another reportedly hot on its heels in McAlester, OK. Two more in Oklahoma City round out the retail giant’s latest DCFC expansion. Find all the locations, open, under construction, and permitted/planned, here: tinyurl.com/WalmartEnergyEVs.

🛌 Francis Energy added two NEVI sites to its collection, both at sites with ample accommodation. Four stalls at Comfort Inn & Suites in Truth or Consequences, NM, and another at a SureStay Plus in Montrose, CO are now online. These are the 14th and 15th NEVI locations for Francis, including two more New Mexico stations in Socorro and Raton.

🔶 Rivian unveiled a new charging page for website visitors, including a clearer look at Adventure Network (RAN) stations that are open to all CCS1-capable models. This includes two new stations in Maple Grove, MN and Norfolk, VA. As the image above shows, the automaker appears to be upgrading RAN locations from east to west, which should make the network accessible to all by the end of the year.

⚡ EVgo added 14 new stalls across three stations in California, Massachusetts, and Texas. The latter is in partnership with Pilot-Flying J at Sandy Oaks, just south of San Antonio, and marks the travel chain’s 26th NEVI-funded location.

🤠 Another positive week for iONNA, building on its newly announced partnership with Wawa. Two new stations energized adds another 20 stalls to the growing network, with Plano Rechargery the company’s fifth location in Texas and Gilman, IL marking its first site in the Land of Lincoln.

Atwater Supercharger in California | Credit: Tesla Charging

🔴 Tesla added 79 new charging stalls across five states: California, Florida, New York, North Carolina, and Tennessee. No mega sites on the scale of the recently opened Lost Hills, CA off-grid Supercharger this week, but Tesla continues to post solid infrastructure numbers every week. But we still await the first “true V4” deployment at 1,000 volts… 👀👀

⭕ Red-E Charging added 22 new stalls across six locations, five of which are in the Northeast. The familiar shape of AUTEL DC charging hardware, wrapped with the Red-E name, is now available to drivers at several network sites in Massachusetts, as well as Waterbury, VT, Elmira, NY, and Slinger, WI.

To see how and where the leading charging vendors are expanding, check out The Network Architect Channel on YouTube for weekly DCFC updates.

The number boffins at Ohm Analytics often send out intriguing snapshots of the EV sector. This latest Flash Report sample for June 2025 is no exception, with trends that could indicate commercial charging reaching saturation point in some key locations, while showing potential for expansion in less established markets.

Here are some of the data points highlighted by Ohm:

📉 4% decrease in commercial charging projects, year over year, comparing the second quarter of 2025 to Q2 2024. This covers the top 20 markets, including the major US coastal metro areas, commercial hubs in Texas + Florida, and other leading EV markets.

⚡Although a monthly comparison reveals a 24% decrease in commercial charging projects for last month compared to June 2024, comparing the first half of 2025 to H124 uncovers a 4% increase in projects so far this year.

🧭 Charging project activity grows 1% YoY when expanded from the top 20 to the top 100 markets, a positive sign for EV charging outside of the largest metro areas in North America.

🚛🚍 An example project outside of leading markets is shared, in the form of Kempower’s partnership with Lane Valente to power New Orleans-based A&S Transportation’s school electric bus fleet. 52 satellite dispensers served by 1.3MW power cabinets demonstrate the scale of fleet charging infrastructure projects being deployed, even away from the headline markets of coastal ports and inland freight corridors.

Although we all want to see numbers heading in the hockey stick direction, the current policy environment and economic uncertainty make slowdowns and stalled projects inevitable.

Understanding which areas of the market are maintaining momentum gives charging vendors and associated operators a better eye for projects and markets that will deliver a reliable return, versus those that represent a gamble on EV infrastructure.

Learn more about Ohm Analytics here and watch for more reports in future editions.

💲DCFC Pricing: NEVI Site Rates vs. National Average

News - Rates for fast charging at stations funded in part by the National Electric Vehicle Infrastructure (NEVI) program are holding a slightly lower rate than the national average, though peaks on some networks show how adding price conditions could make NEVI locations more appealing for EV drivers.

Numbers - $0.53 per kWh is the average price across all current NEVI sites, which ranges from $0.39/kWh (RI DOT/ChargePoint) on the low end to $0.74/kWh (Francis Energy) at its peak. Our most recent EVCPI, shared in edition 26, pegged the national average price for July at $0.54 per kWh, with rates ranging from a very reasonable $0.30/kWh (FPL Evolution) to a highly objectionable $0.95/kWh (Ford Charge).

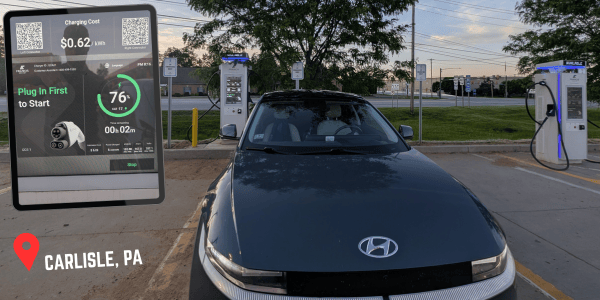

Pricing at a Francis Energy NEVI station in Pennsylvania - $0.62 per kWh

Nuance - Francis Energy and Pilot-Flying J stations prop up the high end of NEVI station rates, with a combined average of $0.60 per kWh. The more reasonable end of the pricing spectrum comprises various entities, from municipal/utility-led locations such as those from Rhode Island DOT, New York Power Authority, and Rocky Mountain Power, and inexpensive regional providers like Kwik Trip’s early stations. Some observers have questioned why stations activated in part with public funds can set rates with such an unpredictable range of pricing. With no price control parameters built into the program’s original guidance, rates remain as variable as those energized with private funds.

Next Up - As we covered last week, NEVI projects in EV-positive states are starting to flow again, following successful legal action. Revised FHWA guidance could yet be issued to influence what remains of the program’s unobligated funds, but it’s unlikely price controls will be on the agenda. For that reason, expect NEVI sites to continue to act as a microcosm of the wider US public charging landscape, which remains in its Wild West phase.

🚛 Ford Pro Summer Update Develops Tools for Fleet Operators

News - Ford Pro's latest update adds battery monitoring, charger visibility, and customizable driver coaching to its electric fleet ecosystem. The refreshed Drive App now displays depot and home EV chargers in real time, streamlining energy logistics.

Numbers - Software improvements are another incremental benefit of electric fleets, though the real savings come from physical operations and maintenance. A recent Ford Pro case study in Boston highlighted the benefits of adding electric vehicles to the city’s fleet. An average of 30-45 minutes was saved for each EV, when comparing labor time of electric models to gas-powered fleet vehicles. The city's overall maintenance costs also went down as a result, estimating the fleet saves around $60-$80 in labor and parts costs per electric vehicle service event.

Credit: Ford Pro

Nuance - The addition of the “Sleep State” feature alerts suggests Ford Pro is leaning into smarter uptime diagnostics, hinting at broader predictive maintenance goals. The alert includes a reason code, opening up greater precision for fleet diagnostics and more nuanced analysis of uptime.

Next Up - From real-time data monitoring and diagnostics to vehicle analysis and optimization, software is increasingly seen as a route to improved fleet operations. As electric models are integrated into fleets, the need to understand how they impact efficiency, costs, and where ops can be improved is ever greater. Against that backdrop, software-defined EVs with incremental updates could be the gift that keeps on giving.

🎧 For Your Listening Pleasure

In every edition, we recommend one of the best listens on electrification, energy, or something similarly EV-related.

This week’s offering comes from Shift, a podcast of Automotive News, and takes us to the subject of what happens to EV batteries once they’re no longer suitable for transportation.

Redwood Materials CCO Cal Lankton discusses the role of the company’s new business unit, Redwood Energy, and its first project in Nevada. That ties some 700 used battery packs together to create the largest microgrid in North America, powering an AI data center as a second-life energy storage system.

🔋💯 Topping Off…

Here’s a selection of news items we couldn’t squeeze into other sections, followed by select EVI incentive program updates we think you’ll want to know about:

Rivian taps Google Maps to improve EV navigation + restarts work on Georgia plant

The application period for California’s FCCP incentives program opens next month (window: 8/5/25 to 10/29/25)

CEC’s Communities In Charge wave 4 funding for L2 connectors ($8,500 per plug - up to 40) coming soon (window opens August 5th, 2025)

If you found this edition useful, share the love by passing it on to a friend, colleague, or family member with an interest in electrification.

See you next week, and remember,

Cheers,

🔔 Essential EV Follow - Michael Greenberg

Based in San Francisco, CA, Michael has worked at the forefront of software development for several decades and sees the state leading US EV adoption.

As SVP of Growth at AMPECO, he now works at the intersection of charging electric vehicles and the software that keeps everything running efficiently.